Cassia Klaus

Sound Design | Audio Engineering

| Music Production

About Me

Art is the backbone of our world. It comes in many different shapes and sizes and it is what keeps us as humans moving, happy, alive. I've always had a passion for the arts, more specifically, music and writing. Touching the world with my art as well as helping others do the same is what I've aspired to do for years, and I'm happy to be able to pursue it now as a career.Over the years, I have worked tirelessly to become a great musician, sound designer, and audio engineer, dipping my toes in everything I can and staying curious, asking questions. I've tried to familiarize myself with different techniques in every aspect of my chosen industries from implementing audio in Wwise to mixing a live session on stage.I have my bachelor's degree in Music Production from Full Sail University in Winter Park, Florida. Through my time at Full Sail, I was able to learn, grow, connect and experience the life of an industry professional. I learned studio etiquette, how to use industry-grade DAWs such as Pro Tools and Logic Pro X, and the tools needed to excel in this industry. I joined clubs and engaged in campus life through the school's Live Event Crew, Loud Ladies club, and 3300+ Rising.Through the various forms of art, I create; from music to mixing to SFX, I hope to have touched the hearts of many and inspire and encourage them to follow their dreams, no matter what they may be.Specialties: sound design, musicianship, vocal performance, music theory, multitasking skills, clear and consistent writing, creativity, editing, video editing, photography, Logic Pro X, Pro Tools, Excel, Word, Powerpoint, organization

Yamaha CL5 Digital Mixer photo by Cassia Klaus

©Cassia-Klaus 2023 All rights reserved.

Dimensions: Live Event Music Assignment

©Cassia-Klaus 2023 All rights reserved.

Deadfield Audio Redesign

©Cassia-Klaus 2023 All rights reserved.

My Resume

©Cassia-Klaus 2023 All rights reserved.

Growing Pains

"growing pains" is a Folk-Rock song that draws inspiration from the works of Taylor Swift. It is an open letter to the artist, Cassia Klaus' younger self telling her not to grow up so fast and cherish her childhood and memories instead of wishing to grow up so fast. Please enjoy!

"growing pains" Lead Sheet

©Cassia-Klaus 2023 All rights reserved.

Walt Disney Entertainment and Comcast Annual Report Analyses

Of all the entertainment companies that are publicly traded and their information at our fingertips, Disney and Comcast are probably the most notable. Disney is known for their parks, their movies, TV shows, and even music. Comcast is known for a plethora of different things as well from movies, TV, theme parks, even the Thanksgiving Day Parade. Because of their notoriety and how similar the two are in nature, I chose to look through their annual reports/10K reports and discuss the content that I discovered within them.As a Disney shareholder, this report was shocking to read to me. It’s a daunting read at first, 123 pages including the title page, table of contents, and conclusory pages which to normal consumers might seem daunting but for me it was an interesting read. Every January and October I would look forward to my bi-annual Disney dividends from the shares I own in Disney stock. However, since the pandemic and a loss of profits at Disney, the company ceased the dividend program. Upon reading the Annual report, I was shocked to find that Disney had declared that they will not be bringing back the dividends program until they “return to a more normalized operating environment.” From the perspective of someone who’s been to the parks in the last year (20 times in 2021), Disney is very much operating at full capability with a steady volume of visitors at the parks every single day, possibly more than usual. This shows me that they’re operating similar to how they did prior to COVID-19 which tells me that it’s returned to a normalized operating environment at least at the level of the parks. The same goes for their television and movies, from what I’ve seen in the perspective of a consumer and shareholder.With that in mind, however, comparing their existing revenue streams and the numbers under their Consolidated Results regarding their total revenue vs net loss it feels a little bit of a cop out not to bring back the dividend program, coming from a Disney shareholder. As of 2021, Disney brought in $59,261,000,000 in revenue accounting for a $2,507,000,000 loss that they recorded in 2020. Considering that, as a consumer and shareholder I feel almost betrayed by the company as dividends account for a small percentage of that to all shareholders. I think companies tend to over exaggerate losses and revenue gains from a consumer perspective and if I can live off of $200 at the end of every paycheck, they can operate off of $59,261,000,000 comfortably I believe. However, I digress.Another interesting aspect of the Annual Report that I found was that their theme park admissions made them a total of $3,848,000,000 in 2021. This accounts for all of their theme parks including the global parks such as Hong Kong Disneyland and Disneyland Paris. However, what was the most interesting to me regarding this was that, while $3 billion is a large number, that is 5% worse than the year prior, 2020. This shocks me because 2020 was an awful year for Disney in terms of ticket sales and people visiting Disney, or at least I thought, due to the COVID-19 pandemic. People weren’t traveling or going to Disney much besides passholders. Most of the countries that Disney parks are located in as well were shut down due to COVID and didn’t reopen for more than a year after their closure. The decrease in revenue or loss in revenue surprises me because I thought that 2021 would be a better year for Disney considering the increase in ticket prices, the increase in ticket sales and the increase in consumer spending at Disney. However, Disneyland, Disneyland Paris and Disney World’s revenue(s) are not indicative of global operations.On the other hand, I took a look at the annual report for Comcast and found that a lot of the same information shocked me and intrigued me. According to a graph that is shown within the first 4 pages of the Annual report, contrary to Disney’s pages of text regarding their breakdowns, Comcast’s Theme Parks only made up 4% of their total revenue. The annual report itself showcased many different graphs from the breakdown of revenue streams to a map of the United States showing cable distribution footprints for consumers and in places where they have consumer relationships. As more of a visual person, I appreciated them adding in the graphs and maps as it made it more inviting and interesting to read and easier to read as well.Continuing to discuss the 2021 Comcast annual report, they are known for their cable television channels stemming from NBC to E! and various other channels on cable television. Considering the recent decline in the popularity of cable television due to streaming being available on nearly all platforms for all to watch, it was surprising to read the numbers of households in the U.S. that still watch these channels and the reach that these channels still have to consumers nationwide. According to their numbers, 80 million households in the U.S. still tune into USA Network, 79 million to E!, 79 million to MSNBC, and 29 million to CNBC World which was a channel I was not aware of existing. The fact that regardless of falling numbers they still hold the attention and interest of that many households nationwide proves that while cable TV may be dying, there are still households out there that watch it as opposed to turning to streaming for their television needs. Truthfully, there is something to be said about the novelty of having a set list of episodes to watch already pre-picked for rather than having to choose them yourself and struggling to pick one that you most want to watch or experience.Now, contrary to Disney’s halt in dividend distribution, Comcast has been steadily distributing their dividends to shareholders and even documents that for January 2022 they will be seeing an 8% increase in their quarterly dividends from $.25 a share to $1.08 a share. Compared to Disney, Comcast seems to be doing more for their shareholders and sees themselves in a better place financially than Disney, especially to be authorizing an increase in the amount of dividends they distribute per share. Moreover, according to their Net Income and Consolidated Revenue report as part of the annual report for 2021, their total net income was $116,400,000,000 which is about 50% more than Disney’s Net Income in 2021. This may explain the difference in confidences regarding the dividend system for shareholders.Similar to Disney, Comcast is also the proud owner of multiple theme parks spanning the globe from Universal Studios Orlando and Hollywood here in the states to Universal Tokyo and Singapore overseas in Asia. Now, Comcast touts a 141.2% increase in revenue from their theme parks in 2021 vs. 2020 going from $2,094,000,000 in 2020 which was a loss for them (obviously due to the pandemic) to $5,051,000,000 which was a gain for them after the disaster that was 2020. This compared to Disney’s reported revenues from their theme parks in 2021 vs 2020 is interesting. Disney reported $16,552,000,000 in total revenue sales from their theme parks in 2021. This includes their resorts, merchandise, food, admissions, licensing and retail, park licensing, and other unidentified streams of revenue. Compared to Comcast which does not break down the costs but made less in revenue than Disney just from their theme parks yet reports a higher net total comapny-wide income than Disney. It is astounding to me that, despite being similar in size and revenue, Disney seemingly cuts more corners than Comcast.Annual Reports (References):https://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQCMCSA2021.pdfhttps://thewaltdisneycompany.com/app/uploads/2022/01/2021-Annual-Report.pdf

©Cassia-Klaus 2023 All rights reserved.

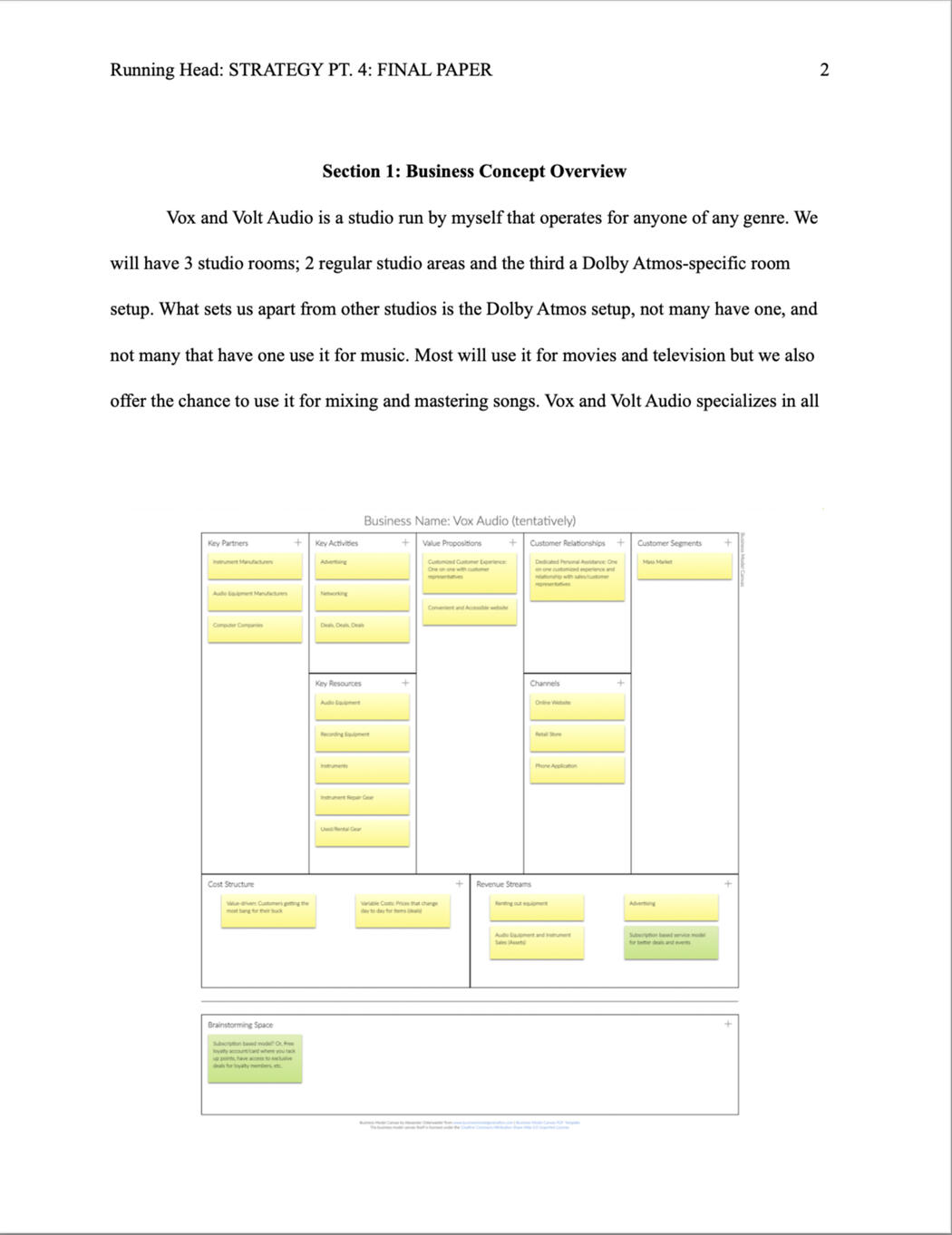

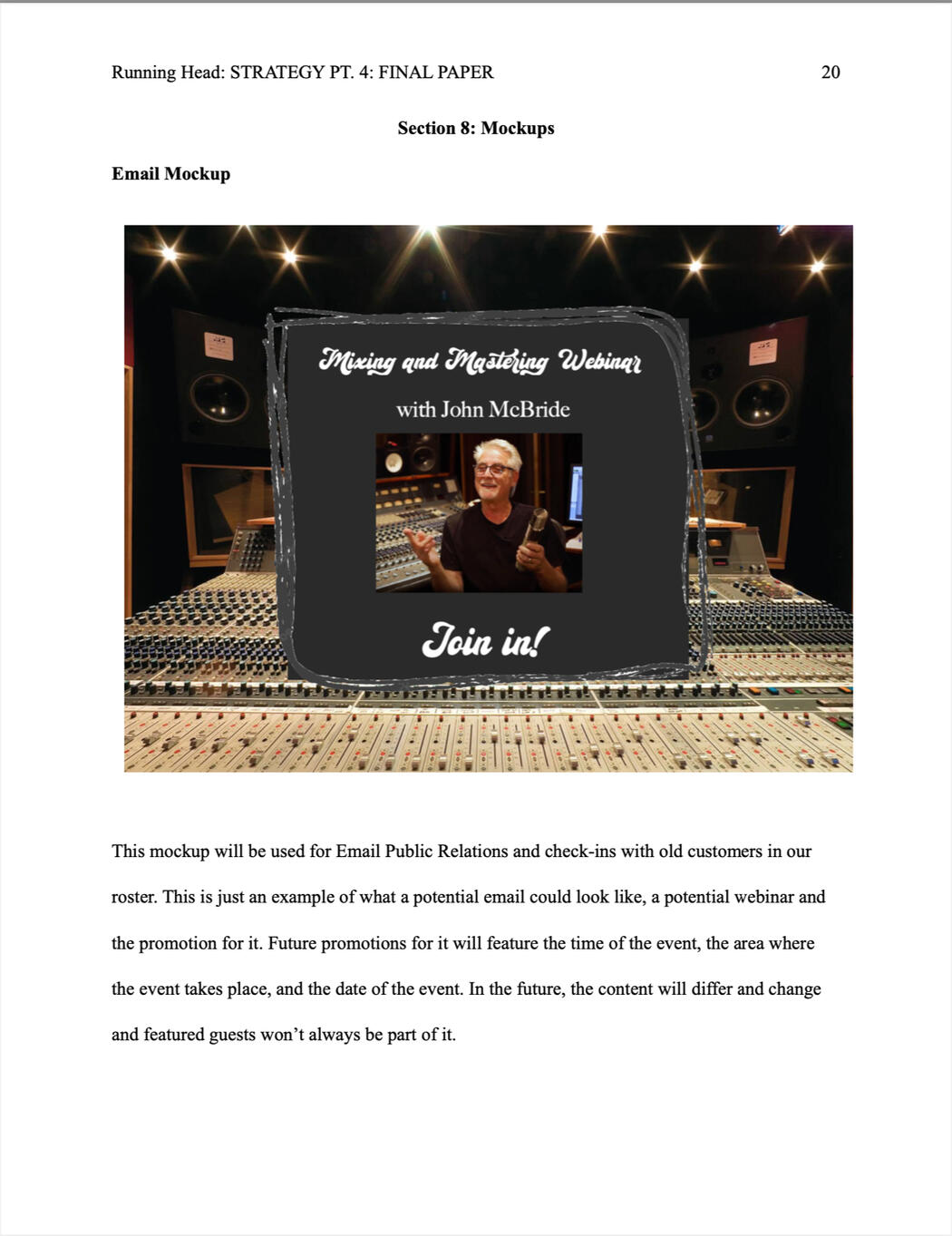

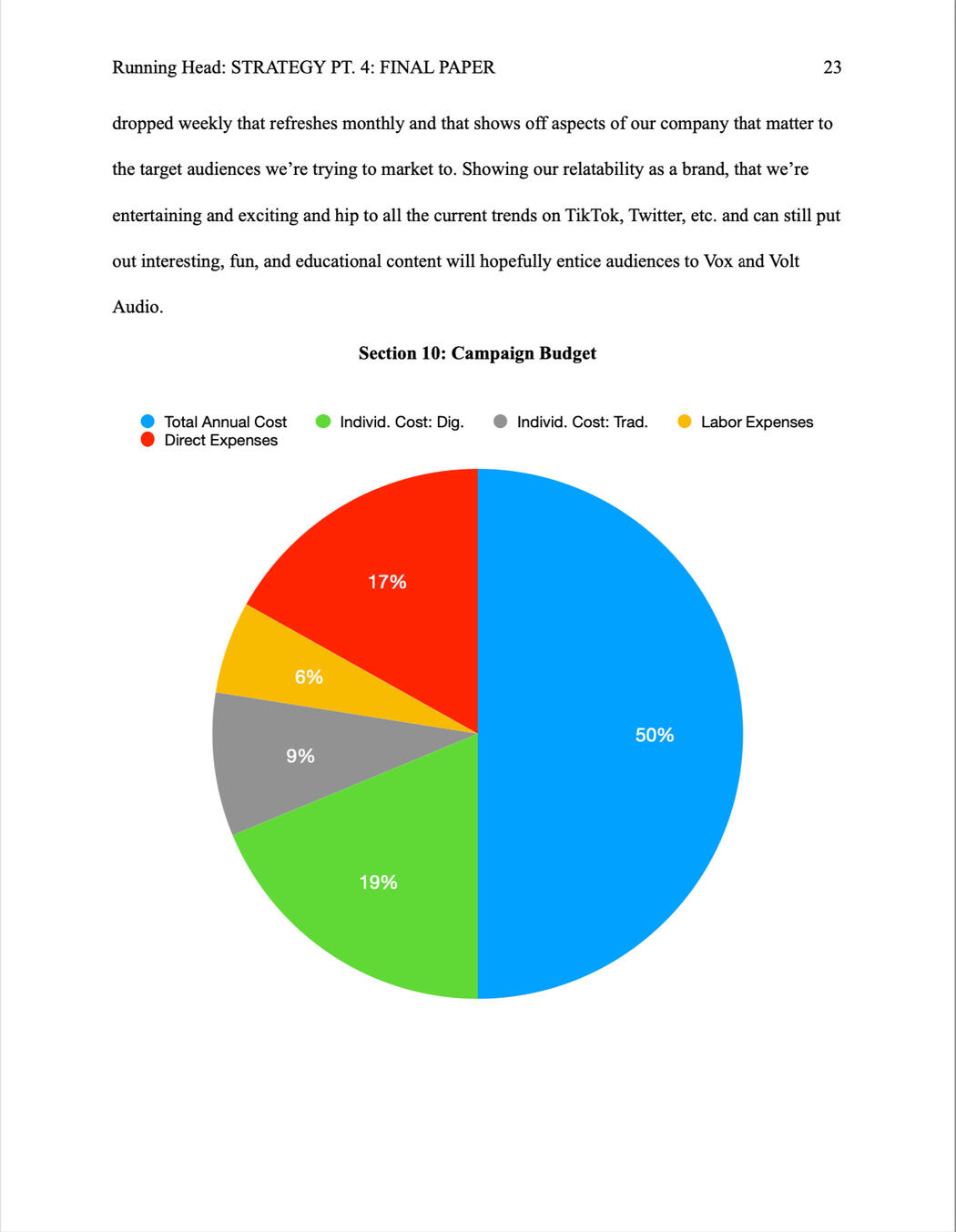

Digital Marketing Strategy/Plan

©Cassia-Klaus 2023 All rights reserved.

Legal Liabilities Video

©Cassia-Klaus 2023 All rights reserved.

@Cassia-Klaus 2023 All Rights Reserved.